Discover the 15 best ETFs to invest in India for 2025. Explore top-performing funds across equity, gold, debt & sector ETFs with detailed returns & insights. India's Exchange Traded Fund (ETF) space has grown rapidly, offering a variety of choices across equity, gold, bonds, and sectoral themes. Based on historical performance up to January 30, 2024, here’s a list of top-performing ETFs to consider for 2025:

📊 Performance Overview of Top Indian ETFs

| ETF Name | Symbol | 1-Year Return | 3-Year Return | 5-Year Return |

|---|---|---|---|---|

| Nippon India ETF Junior BeES | JUNIORBEES | 15.45% | 31.14% | 125.92% |

| SBI Nifty Next 50 ETF | SETFNN50 | 16.32% | 48.39% | 126.35% |

| Kotak NV 20 ETF | KOTAKNV20 | 14.58% | 48.15% | 156.13% |

| Invesco India Nifty ETF | IVZINNIFTY | 6.86% | 31.15% | 97.10% |

| Motilal Oswal M50 ETF | MOM50 | 6.43% | 30.56% | 98.83% |

| Quantum Nifty ETF | QNIFTY | 7.00% | 32.00% | 98.10% |

| Bandhan Nifty ETF | IDFNIFTYET | 7.03% | 32.49% | 104.19% |

| SBI Nifty 50 ETF | SETFNIF50 | 7.38% | 32.04% | 93.03% |

| Invesco India Gold ETF | IVZINGOLD | 24.12% | 58.52% | 94.07% |

| Kotak Nifty Bank ETF | BANKNIFTY1 | 4.73% | 30.02% | 52.41% |

| Nippon India ETF Shariah BeES | SHARIABEEE | 5.02% | 10.48% | 100.26% |

| SBI 10 Year Gilt ETF | SETF10GILT | 8.63% | 17.66% | 24.87% |

| Nippon India ETF Bank BeES | BANKBEES | 3.01% | 26.06% | 52.93% |

| UTI BSE Sensex ETF | SENSEXETF | 7.42% | 31.12% | 89.17% |

| CPSE ETF | CPSEETF | 20.92% | 157.93% | 250.17% |

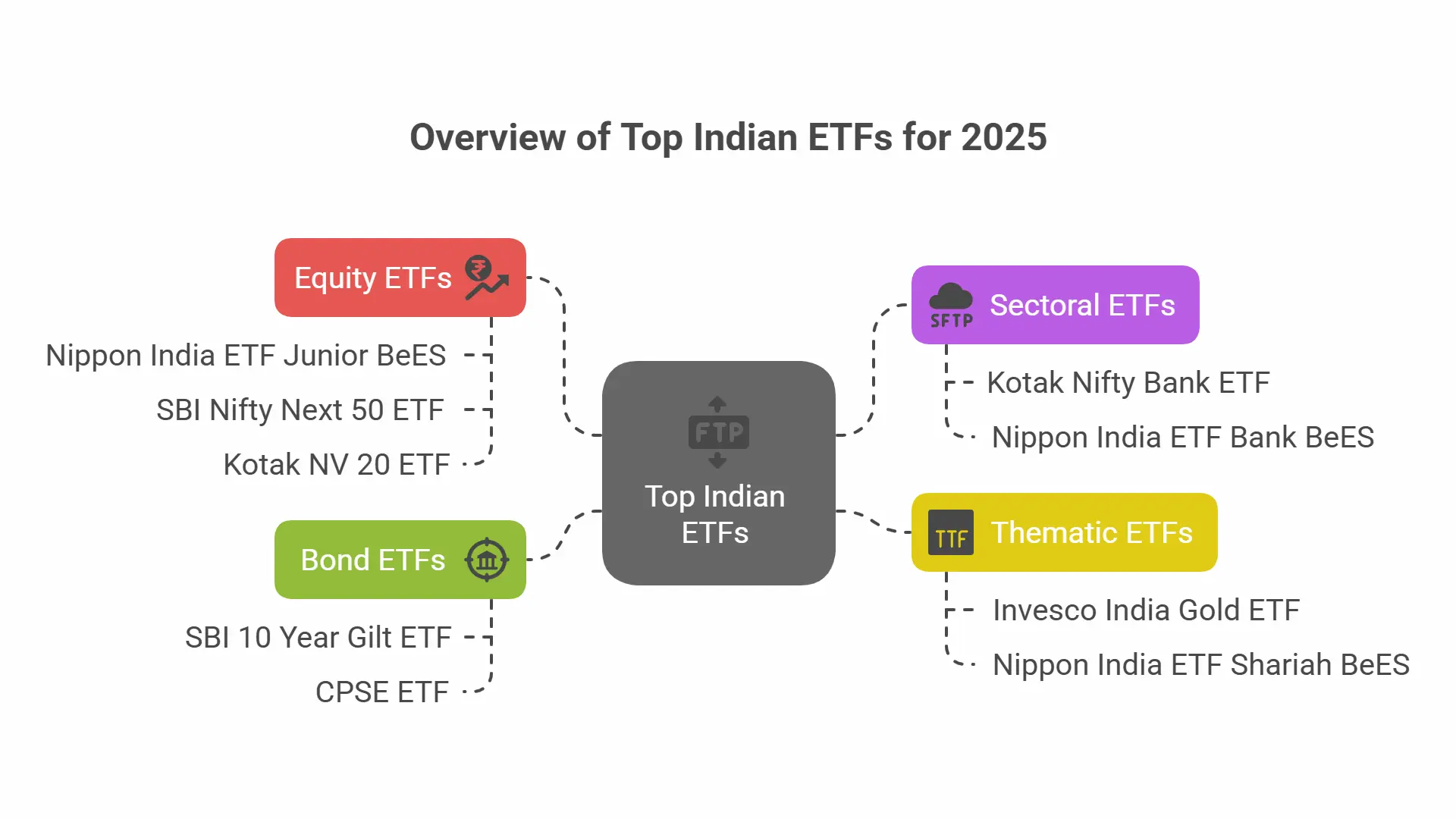

🔝 Highlighted ETFs for 2025

Here’s a snapshot of the most notable ETFs:

- Nippon India ETF Junior BeES (JUNIORBEES)

- Tracks Nifty Next 50. A strong performer, especially over the long term.

- SBI Nifty Next 50 ETF (SETFNN50)

- Exposure to future potential blue-chips; robust returns across timeframes.

- Kotak NV 20 ETF (KOTAKNV20)

- Targets value stocks in Nifty 50; excellent long-term growth.

- Invesco India Nifty ETF (IVZINNIFTY)

- Diversified exposure to top 50 companies in India.

- Motilal Oswal M50 ETF (MOM50)

- Consistent returns with Nifty 50 exposure.

- Quantum Nifty ETF (QNIFTY)

- Offers cost-effective access to India's largest stocks.

- Bandhan Nifty ETF (IDFNIFTYET)

- Newer fund, but showing solid medium-term results.

- SBI Nifty 50 ETF (SETFNIF50)

- Reliable and well-managed, suitable for core portfolios.

- Invesco India Gold ETF (IVZINGOLD)

- Ideal for diversification; tracks gold prices.

- Kotak Nifty Bank ETF (BANKNIFTY1)

- Focused on the banking sector, useful for sectoral allocation.

- Nippon India ETF Shariah BeES (SHARIABEEE)

- Shariah-compliant, investing in select large-cap stocks.

- SBI 10 Year Gilt ETF (SETF10GILT)

- Exposure to government bonds; best for low-risk strategies.

- Nippon India ETF Bank BeES (BANKBEES)

- Replicates Nifty Bank Index; solid long-term sector play.

- UTI BSE Sensex ETF (SENSEXETF)

- Tracks top 30 BSE stocks; balanced performance.

- CPSE ETF (CPSEETF)

- Invests in PSU stocks; exceptional recent performance.

🧠 What Are ETFs?

An Exchange Traded Fund (ETF) is a collection of securities—like stocks or bonds—that trades on an exchange like a regular stock. It provides diversified exposure in a single investment.

Example: Buying a Nifty 50 ETF gives you indirect ownership of all 50 companies in the index with just one purchase.

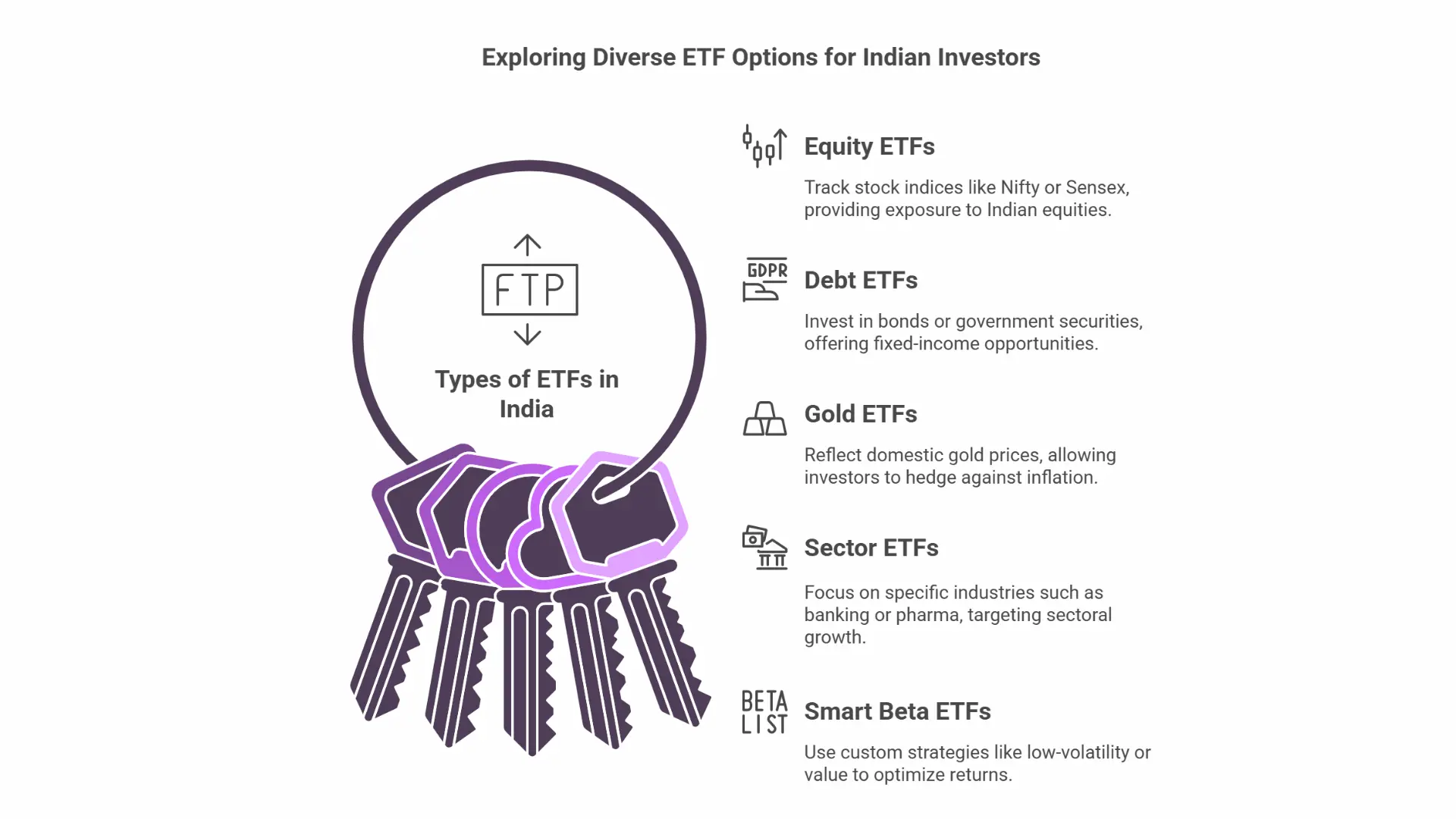

🧾 Types of ETFs in India

| Type | Description |

|---|---|

| Equity ETFs | Track stock indices like Nifty or Sensex |

| Debt ETFs | Invest in bonds or government securities |

| Gold ETFs | Reflect domestic gold prices |

| Sector ETFs | Focus on industries like banking or pharma |

| Smart Beta ETFs | Use custom strategies like low-volatility or value |

| International ETFs | Offer exposure to global markets |

🥊 ETFs vs. Mutual Funds

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading | Real-time like stocks | End-of-day NAV |

| Minimum Investment | Low | Sometimes ₹5,000+ |

| Expense Ratio | Lower | Higher (for active funds) |

| Transparency | Daily holdings | Monthly/Quarterly |

| Tax Efficiency | Higher | Moderate |

📈 ETFs vs. Stocks

| Feature | ETFs | Stocks |

|---|---|---|

| Diversification | High (basket of assets) | Low (single company) |

| Risk | Lower | Higher |

| Management | Passive | Requires research |

| Dividends | From multiple companies | From one company |

🚀 How to Invest in ETFs in India

- Open a Demat & Trading Account – Click Here To Open a Demat Account .

- Pick an ETF – Choose based on your risk profile and investment goal.

- Place the Order – Use your trading platform to buy the ETF like a stock.

- Track and Rebalance – Monitor your portfolio and make adjustments periodically.

Example: Want to invest in Nifty 50? Just search "NIFTYBEES" and place your order.

✅ Final Thoughts

ETFs are a smart way to invest in India's growing economy. They combine diversification, transparency, and low costs, making them ideal for both new and experienced investors.

Whether you’re seeking exposure to top companies, sector-specific opportunities, or simply want to include gold and bonds in your portfolio, India’s ETF market has something for everyone.

📌 Disclaimer

This content is for educational purposes only. It is not investment advice or a recommendation to buy/sell any securities.