Table of Contents

- What is a 1 DTE Call Ratio Spread?

- When to Use This Strategy

- Entry & Exit Rules

- Given Legs (Detailed Tables)

- Two Practical Examples

- Risk Management & Tips

- FAQ

- Conclusion

Short, practical, and expiry-focused: The 1 DTE Call Ratio Spread is a high-probability, short-duration options setup ideal for traders expecting limited upside or range-bound movement during expiry week.

What is a 1 DTE Call Ratio Spread?

A Call Ratio Spread involves buying one call (usually ATM or near-ATM) and selling two calls further out-of-the-money (OTM). When deployed with 1 day to expiry (1 DTE), it becomes a short-duration trade that profits from accelerated time decay (theta) and small or no upside movement.

When to Use This Strategy

- Volatility (VIX): Preferably low (for example, VIX < 13).

- Market bias: Bearish to sideways or mildly bullish.

- Timing: Best placed 1–2 days before expiry (1 DTE trades are time-sensitive).

Entry & Exit Rules

Nifty Setup (Suggested)

- Entry time: 3:15 PM on Friday (or 1–2 days before expiry).

- Legs: Buy 1 ATM Call (min premium ₹80). Sell 2 OTM Calls 100 points away (each premium >50% of bought call premium).

- Validity: Ensure a net credit at entry. If net debit, skip the trade.

- Exit: Target profit 0.3%–0.4% of deployed capital. Stop loss 0.3% of capital.

Sensex Setup (Suggested)

- Entry time: 3:15 PM on Tuesday (or 1–2 days before expiry).

- Legs: Buy 1 OTM Call (300 points from ATM; min premium ₹200). Sell 2 OTM Calls another 300 points away (each premium >50% of bought call premium).

- Exit: Same targets as Nifty — profit target 0.3%–0.4%, stop loss 0.3%.

Given Legs — Leg Details Table

Nifty — 1 DTE Call Ratio Spread (Legs)

| Leg | Action | Strike (example) | Lots | Notes |

|---|---|---|---|---|

| 1 | Buy Call | ATM (e.g., 19,500 CE) | 1 Lot | Minimum premium ₹80 (Delta ~0.30) |

| 2 | Sell Call | ATM + 100 pts (e.g., 19,600 CE) | 2 Lots | Each premium >50% of bought call premium |

Sensex — 1 DTE Call Ratio Spread (Legs)

| Leg | Action | Strike (example) | Lots | Notes |

|---|---|---|---|---|

| 1 | Buy Call | ATM + 300 pts (e.g., 65,300 CE) | 1 Lot | Minimum premium ₹200 |

| 2 | Sell Call | ATM + 600 pts (e.g., 65,600 CE) | 2 Lots | Each premium >50% of bought call premium |

Two Practical Examples

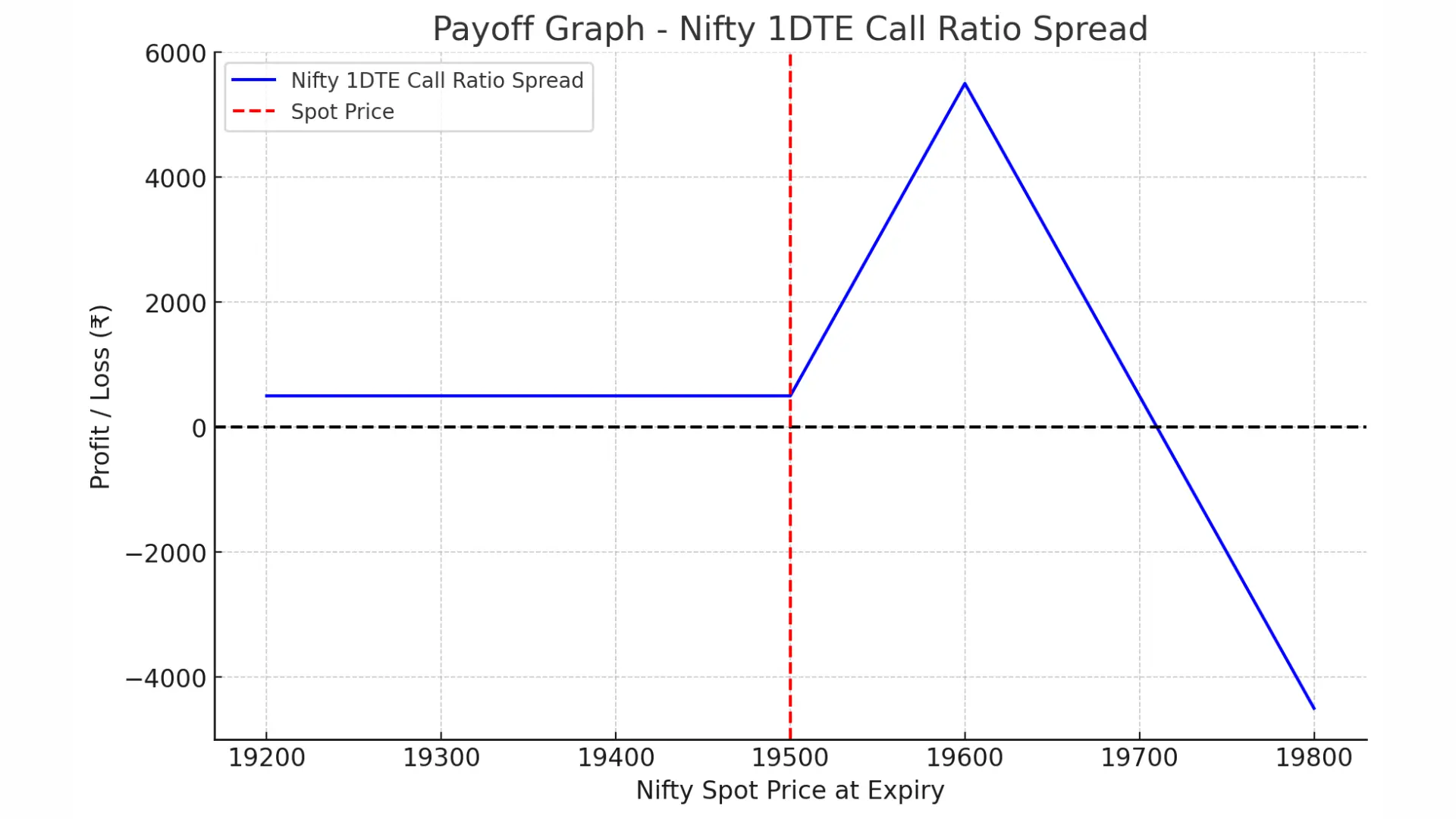

Example 1 — Nifty 1 DTE Call Ratio Spread

Spot: Nifty @ 19,500

| Leg | Action | Strike | Premium (₹) |

|---|---|---|---|

| Buy | 1 Lot | 19,500 CE | 100 |

| Sell | 2 Lots | 19,600 CE | 55 each (total ₹110) |

| Net Credit: ₹10 (₹110 - ₹100) | |||

Outcome: If Nifty remains around 19,500–19,600 at expiry → time decay works in your favour. If Nifty rallies strongly above 19,600 → limited loss beyond breakeven; if Nifty falls → profit equals net credit.

Here are the effective payoff graphs for your examples:

Nifty 1DTE Call Ratio Spread – Buy 19500CE, Sell 2x 19600CE

✅ Clear profit/loss curve

✅ Breakeven levels marked

✅ Spot price highlighted

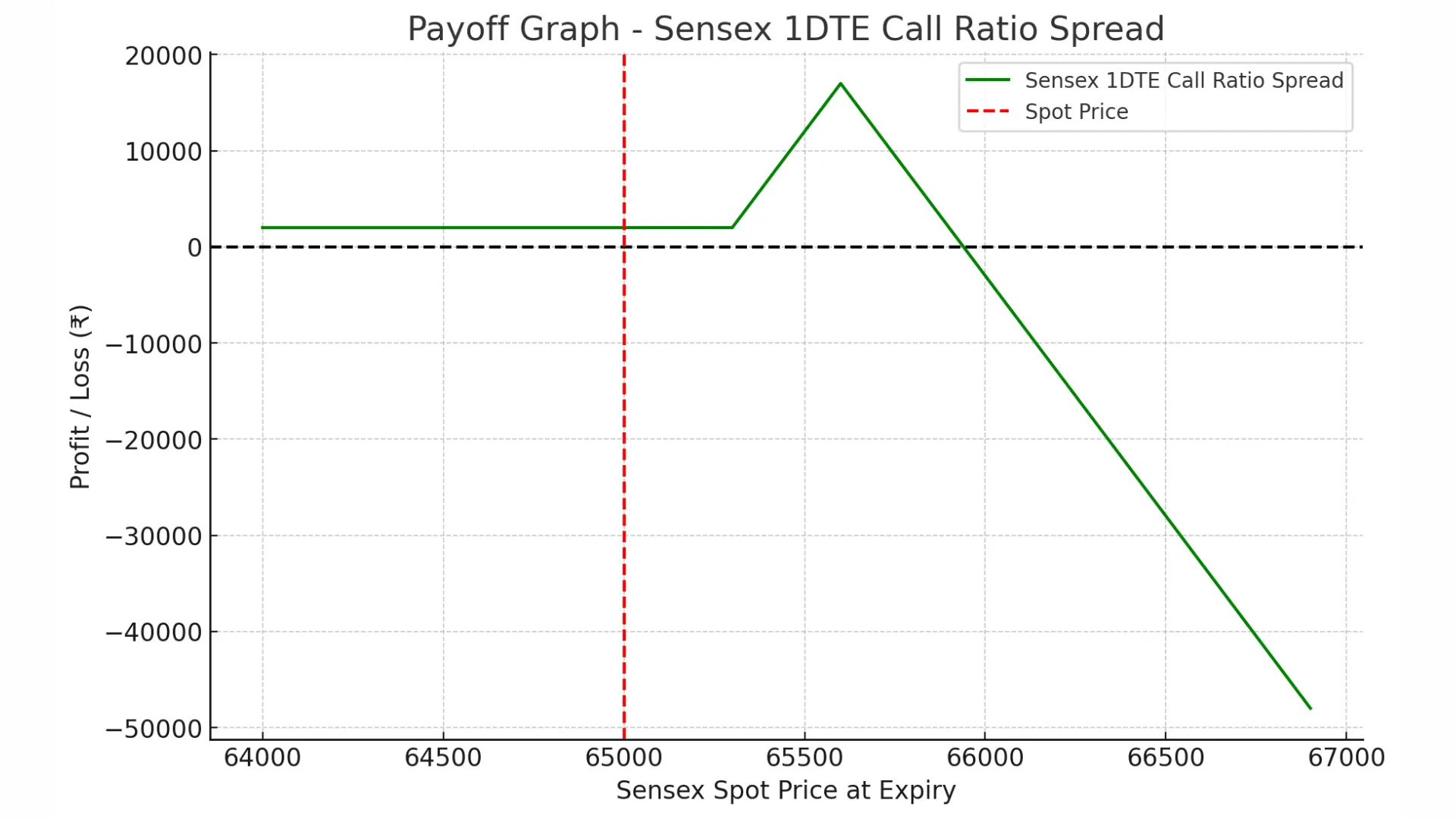

Example 2 — Sensex 1 DTE Call Ratio Spread

Spot: Sensex @ 65,000

| Leg | Action | Strike | Premium (₹) |

|---|---|---|---|

| Buy | 1 Lot | 65,300 CE | 220 |

| Sell | 2 Lots | 65,600 CE | 120 each (total ₹240) |

| Net Credit: ₹20 (₹240 - ₹220) | |||

Outcome: If Sensex closes between 65,300–65,600 → maximum profit. If it rises beyond 65,600 → limited losses; if it falls → profit equals net credit.

Here are the effective payoff graphs for your examples:

Sensex 1DTE Call Ratio Spread – Buy 65300CE, Sell 2x 65600CE

✅ Clear profit/loss curve

✅ Breakeven levels marked

✅ Spot price highlighted

Risk Management & Practical Tips

- Always confirm net credit before taking the trade.

- Keep capital aside for adjustments. 1 DTE trades can move fast — be ready.

- Set strict profit targets and stop-loss levels (suggested: 0.3%–0.4% target, 0.3% stop-loss of deployed capital).

- Use limit orders to avoid slippage on short-duration trades.

- Avoid trading before major news/events even in 1 DTE setups.

FAQ — Frequently Asked Questions

Q1: Is the 1 DTE Call Ratio Spread risky?

A: Like all options strategies, it carries risk. Because you sell more calls than you buy, extreme upside moves can cause losses. Using strict stop-loss and capital allocation limits that risk.

Q2: Can this be used in high volatility?

A: It’s best in low-to-moderate volatility. High volatility increases premiums and the chance of sharp moves.

Q3: What if the trade shows a net debit at entry?

A: Skip the trade. The premise of the strategy is a net credit entry that benefits from theta decay.

Q4: How much capital do I need for 1 DTE trades?

A: Capital depends on the lot sizes and margin rules of your broker. Keep enough to cover margin requirements and possible adjustments.

Q5: How do I manage assignment risk?

A: For index options in India (Nifty/Sensex), physical assignment is not an issue as these are cash-settled. For stock options, be aware of assignment risk and manage position size.

Conclusion

The 1 DTE Call Ratio Spread is a focused, short-duration strategy that seeks to capture time decay in expiry week while limiting downside through a conservative long call. With clear entry/exit rules, strict risk management and capital reserved for adjustments, this strategy can generate consistent returns in range-bound or mildly bullish markets.

Note: This content is educational and not investment advice. Always test strategies on paper or in a small live size and consult a licensed advisor if required.

— End of article —